I’ll admit – I’m surprised myself by how low the profitability even of “high-end” Android OEMs is. I hadn’t investigated it in detail until I wrote this post.

The end of 2014’s fourth calendar quarter, and hence year, brought forth a blizzard of data about the mobile and the smartphone markets. The mobile market (so including featurephones) passed the 500m mark for the quarter, according to Counterpoint. The smartphone chunk is growing as a proportion of that faster than ever: in Q4 it made up about 75% of sales.

As a proportion, smartphone sales are rising healthily:

That compares with a 58% smartphone mix in 4Q 2013. Even so, I don’t expect the 90% mark to be hit before 1Q 2018 (yes, 2018), on the assumption their sales rise as a diffusion curve.

If the proportion continues at about a 3% increase in smartphone share per quarter (as happened roughly in 2014), smartphones will be 90% of sales in 1Q 2016 – just a year away – and 95% in 3Q 2016. By then, effectively all the market is smartphones.

Apple’s enormous sales – 74.5m units shifted – attracted lots of the attention. It ended the quarter with less inventory in the channel than at the start, suggesting that sell-through (ie the number bought by people) was actually higher.

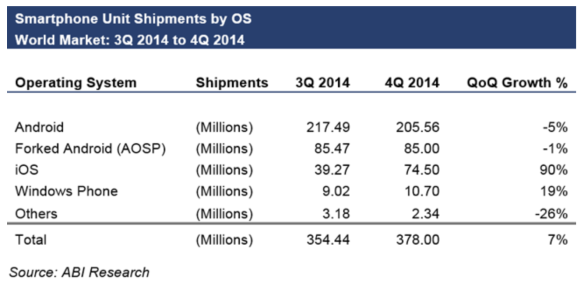

But the really surprising figure – the one that had me firing off emails asking for more detail – came not from Apple, nor any individual company, but from ABI Research. Its headline: “Android Smartphone Shipments Fall for the First Time”.

Wow. I mean, truly wow. As it says, that’s never happened before. Android shipments have always increased from quarter to quarter, both for “Google Android” and AOSP, since the platform’s first phone. (Unlike pretty much every other research company, ABI also breaks its Android figures down into “Google Android” – ie Google Mobile Services certified, carrying all Google’s services – and “AOSP” – principally, China.)

Yet here ABI is, saying G-Android shipments fell by 11.9m, and AOSP by 0.47m, a total of 12.4m. That’s quite a lot more than a margin of error.

Objection!

Now, you could object right away. There are lots and lots of research companies to choose from, and all are pushing their own datasets, and all diss each others’ datasets in more or less subtle ways. There’s IDC, Gartner, Counterpoint, ABI, Strategy Analytics, Canalys, CCS Insight, Kantar, and more. Couldn’t ABI be wrong?

It could. But then you also have the numbers that come from the companies themselves. Samsung helpfully said that in the fourth quarter it shipped a total of 95m mobile phones (ie featurephones and smartphones) – and that smartphones were in the “high 70 percent” range.

So… how high in that 70s exactly? Because if it wasn’t in the 78.5% or above range, it was less than Apple. But Samsung wouldn’t want to admit that. Sony also reported numbers, as did LG, and Lenovo. LG’s numbers fell from 3Q to 4Q, Sony’s grew, Samsung’s fell, Lenovo’s and Motorola’s both fell independently. Together, they lost 6.5m sales from 3Q to 4Q, at a time when you’d expect sales to rise.

Let Jeff Orr of ABI Research explain it in a bit more detail.

“China was definitely the lead influencer in the OS share change during 4Q’14. ABI will be a lot more precise once the final vendor tallies are announced and tallied.

“Thinking about Apple’s financial call, Tim Cook highlighted exceptional iPhone growth in the US (up 44% QoQ) and BRIC [Brazil, Russia, India, China] region (up 97% QoQ), adding that China was the company’s second largest iPhone customer for the quarter and that Singapore and Brazil also saw significant increases (though these last two were not given any numbers).

“Apple also noted the amount of Android-to-iPhone switching it observed in the quarter. Given Apple’s premium price points in the smartphone world, one has to believe that switching impacted a subset of all Android handset makers that would be comparable in ASP to iPhone (or at least within a similar pricing tier). Again, it’s too early to name names here just yet, but you can probably guess the likely Android vendor names to put in that bucket.”

The competitors

Basically, it’s the big companies that compete directly with Apple – so Samsung, Sony, LG, HTC – and to a lesser extent Chinese companies such as Lenovo and perhaps (though it’s not certain) Xiaomi, whose shipments fell from the third to the fourth quarter.

Apple stole customers who might otherwise have bought Android phones away from those makers, and that helped cause a fall in sales.

How many iPhone users upgraded?

Note Cook’s comments on the earnings call about how many of the existing iPhone base upgraded to the iPhone 6 and 6 Plus: he put it in the “low to mid teens percent of the existing base” (these chief executives and their vague percentages, eh?). So how many is that?

Assuming a 400m iPhone base before the fourth quarter, and 13% upgrading to the 6/6 Plus (the minimum possible): 52m iPhones.

Assuming a 440m iPhone base, and 15% upgrading: 66m.

So if you subtract those from the sales figures, you get between 8.5m and 22.5m who were new to the iPhone – either upgrading from a featurephone, or coming over from Android.

Split the difference and you get 15.5m. That’s surprisingly close to the 12.4m figure earlier of “missing” Android sales from ABI Research; and you’d also expect that there would be sales growth from the third to the fourth quarter, which is the largest by volume of the year. Perhaps up to.. 15.5m more phones? (Update: Canaccord puts the user base at 404m, and the upgrade percentage at 15%, which gives 60.6m upgrades, and so 14.4m upgrading a featurephone or coming from Android.) (Second update: Mav, in the comments, points out that the total iPhone 6/6 Plus sales includes those sold in the third calendar quarter, at the end of September when they went on sale. That means an extra 10m and more sales of the iPhone 6/6 Plus. So it’s a very substantial landgrab from featurephones and Android.)

So it looks like Apple actually skimmed off some of Android’s growth in the fourth quarter. What’s worse for the Android OEMs is that Apple tends to grab two classes of customers: the loyal ones (who just keep buying Apple stuff – see how the majority of buyers were loyal ones here), and the high-paying ones, especially in China and the west, where its brand is able to command a premium price. Then it converts those high-paying customers into loyal ones.

That’s notable from Samsung’s apparent mobile ASP (average selling price – what it gets from carriers and wholesalers), which dipped badly in Q3 and came back only slightly in Q4, helped by the Galaxy Note 4. Even that couldn’t help against Apple’s iPhone 6 Plus – note how Apple’s ASP rose while Samsung’s fell in Q4.

Figures for Samsung ignore revenues from featurephones, which are comparatively tiny compared to its smartphone revenues

Samsung’s smartphone shipments are reckoned to have fallen from 78.5m in the third quarter – to (if we’re generous) 74.5m, equal to Apple, in the fourth. That’s down from 82m a year before (a 9% fall).

The value trap, Android version

Let’s be clear: I think Android is a boon to the world; quite possibly it’s the best invention of this century so far. (I’ve said as much many times, but some people find this hard to understand.) It’s a great thing that people who previously couldn’t get internet access at all can now get a cheap handheld device capable of running apps that can provide all sorts of information, and use far less power and are far more portable than a PC. Smartphones put power in the palm of your hand; and Android is the OS of choice for that.

However, for handset manufacturers, Android isn’t such a boon. Take a look at the operating profit and margins for the top-end Android OEMs. (I use operating profit rather than gross profit because it takes into account the costs of actually competing in the market through marketing, R+D and so on – not just what you take over the counter).

I’ve estimated HTC’s shipments at 6m, based on Sony and LG’s revenues and shipment numbers (it comes out between 5m and 7m, depending which you use).

Top-end Android handset revenue and profits, compared to Apple

| OEM | Handset revenue US$ (approx) | Operating profit US$m | Operating margin % | handsets shipped | Implied ASP per phone | Implied profit per phone |

| HTC | $1.6bn | $6m | 0.38% | 6m *est | $266 | $1 |

| Sony | $3.6bn | $79m | 2.2% | 11.9m | $305 | $6.64 |

| LG | $3.45bn | $74m | 1.8% | 15.65m | $220 | $4.72 |

| Lenovo (inc Motorola) | $3.39bn | -$89m | -2.6% | 24.7m | $137 | -$3.13 |

| Samsung | $22.8bn | $1,790m | 10.0% | 74.5m | $306 | $24.02 |

| Total for Android |

$34.84bn | $1.86bn | 5.3% | 132.75m | $262 | $14.01 |

| Apple | $51.2bn | $14.3bn (at 28% margin) |

28% (est) | 74.5m | $687 (actual) |

$191.9 |

Note that these are rough-and-ready figures. Here are a few of the caveats.

• For Sony, Lenovo and Samsung I haven’t accounted for tablet sales, which in Samsung’s case were 11m at an unknown ASP; for Lenovo tablet numbers weren’t stated (though it puts them at 4.8% worldwide, which would be 3.6m out of 76.1m). I haven’t even tried to estimate them for HTC, which in its financial report on Q4 doesn’t even mention the Nexus 9 it made for Google which went on sale in Q4.

• The Samsung figures overstate smartphone revenues, because they ignore the 20m or so featurephones which will have had an ASP of around $15 and unknown profit. Samsung’s mobile profits have risen in line with its smartphone shipments, so we can reason that its featurephones have less profit than smartphones; so ignoring their revenue and assigning their profits to smartphones is generous, but not madly so. Also, Samsung’s profit figure is for its “IM” division, which includes PCs, of which it sells a few million per quarter but probably doesn’t get much more than $10-20 of operating profit per sale.

• ASPs are thus approximate, and so are profit estimates: tablets might be money losers, depressing the apparent profitability of the handset business. But what all these companies except Samsung have in common is that their handset businesses have lost, or are losing, money. So these probably aren’t that far off; tablets might be less profitable, but there are fewer of them to spoil the numbers.

• These are only top-end Android phone makers. There is a ton of others: ABI reckons there were a total of 303m G-Android and AOSP phones shipped in the quarter, so more than half of those aren’t accounted for in this total. Many of them are cheaper (Huawei, ZTE, Coolpad, Micromax come to mind) and ship in volume. Being cheaper, they’re unlikely to make a lot more profit, and since they don’t appear in the top five, they probably don’t make much difference to these figures except downwards in ASP and per-handset profit.

• Apple gives the number of phones shipped and total revenues (so you can calculate ASP) but doesn’t break out the operating profit of its divisions; analysts make estimates. I got the 28% operating profit figure from this 2013 analysis by Canaccord. Update: for 4Q 2014, Canaccord puts iPhone operating profit at 38%, which is colossal, and would make that table look even more lopsided. (Canaccord reckons Apple has 79% of mobile profits, and Samsung 25%; the others have between 0% and 1%, if they’re profitable.)

So what does this tell us?

That 2013 Cannacord estimate isn’t the most recent but things are unlikely to have shifted far – and even if they’ve moved by a few percentage points, it still doesn’t change the overall picture. Apple makes a ton of profit per phone, and top-end Android OEMs generally don’t. (Motorola has been a basket case for years, and dragged down Lenovo’s figures; see Jan Dawson’s analysis of how that’s affected the mobile bottom line.)

You can argue – and lots of people do – that Apple is therefore “charging too much for the iPhone, and it should cut the price so that more people would buy it”. This is superficially attractive logic to people who (a) aren’t running a business and (b) can’t think long-term.

For Apple, the cash it rakes in is used to reinvest in factory and supply contracts in ventures for forthcoming products. If it didn’t have that surplus cash, it couldn’t buy fingerprint reader companies, lock up supplies of camera sensors, guarantee enough factory production to make 74.5m phones, fund machinery to diamond mill the sides of phones, and pay forward for whatever it’s going to do over the next two, five, ten years.

(But what about that cash mountain? Well, lots of that is profits earned abroad that Apple doesn’t want to repatriate to the US, because that would attract a high rate of interest tax, so it leaves it sitting in Ireland and reinvests it in those things as above.)

By contrast, the Android OEMs whose phone divisions are living hand-to-mouth on those incredibly slim margins can’t afford to reinvest. They’re essentially at the mercy of the rest of the smartphone and component ecosystem.

For example, they can implement a fingerprint scanner (HTC and Samsung have) but it’s incomplete; HTC didn’t use it across all its models and it wasn’t part of a payment system – as Apple Pay is, carefully planned over a two-year arc. Similarly, 64-bit Android hasn’t happened to any appreciable extent, and while you can argue about whether 64-bit makes a difference (these ARM engineers reckon it does, and explain why), Apple is still a mile ahead of the rest in implementing it. Lots of Android has to move at the pace of the slowest part of the hardware ecosystem, much of which is 32-bit.

Note that three of the four top-line OEMs are part of large conglomerates which collectively make everything from camera sensors to games consoles to TVs to washing machines to memory chips. That means the smartphone divisions are effectively a bit of icing on the main, hopefully profitable, other parts of the business, and also that they can bear quite sizeable losses for a while (LG and Sony have). For Samsung, mobile enjoyed a spell in the sun; now the chip business has become dominant again. HTC’s survival is anomalous, but somehow heartening.

High-end Android – trying to compete with Apple, especially in the fourth and first quarters (because the latter is a gift-giving time in China particularly) – is becoming a rich man’s game, with low returns. Nor are these ASPs and profits for the fourth quarter unusual; tracking them over time you see similar figures. LG’s average smartphone operating margin for the past 8 quarters is 1.3%; for HTC it’s -1.4%; for Sony it’s a few percent.

In fact, they’re all caught in the “value trap” that I wrote about a while back for the PC market: because they don’t control the software, there’s little chance to differentiate. These companies are vulnerable to customers who choose simply on price. That means only those who can manufacture at scale or compete locally can benefit.

So what’s do we conclude?

• Android will continue to be gigantic. For local OEMs in countries like India and China, it offers huge opportunities for scale

• high-end Android handset makers will keep struggling, against Apple and notably against Samsung – which is meanwhile struggling with the aforementioned local OEMs (which eat into its low-ASP base) and Apple, which is stealing its top-end customers

• there’s little opportunity even for high-end Android OEMs to invest and innovate, because it’s not profitable enough. Only Samsung is an exception, because it’s part of a gigantic conglomerate. All are weak in software, and there’s no sign of that changing.

The giant in the niche

A niche player? Apple’s share of the overall mobile market (including featurephones) is at 10% for the past year, and 15% in the past quarter.

Apple’s a niche player – if that’s what you want to call the largest smartphone OEM – but it’s the most valuable niche, and also the one that lets it decide what people view as “valuable” in a phone. (For example, waterproofing hasn’t helped the Sony Xperia range or the Galaxy S5 sell, despite being a distinction compared to the iPhone range. Having a fingerprint sensor apparently has helped the iPhone 5S onwards.)

If Apple has the most valuable and the most loyal customers (and especially if it gets the most loyal valuable customers) then that means it can continue to expand its ecosystem, continue to charge a premium, continue to make big profits, continue to buy up companies that rivals had their eyes on, aim to undercut others in the services it offers.

Skimming off the top end gives Apple huge leverage. Ben Bajarin reckons Apple has about 60% to 70% of the “premium” market. On the basis of that 400m-440m user base (and don’t forget another 100m iPads and some iPod Touches too, though probably with a lot of overlap), that suggests there’s a total premium market worldwide of about 750m smartphone users worldwide. If Apple keeps pulling in 10m or so of them every quarter, it’s going to be a monster.

Update: Canaccord’s latest February 2015 calculation (which appeared the day I published this) reckons it will reach 650m by the end of 2018 – though it thinks that will be only a third of a global premium audience of 1.8bn. Android’s got plenty of room to grow. But so, it seems, has Apple.

Certainly this turn of events comes as no surprise to the executives running these companies? At least I like to think they were smart enough to see it coming. Surely they know the history of IBM PC clone OEMs. The last three decades are littered with the carcasses of dozens of PC-clone OEMs. The operating system vendor (Microsoft) walked away with all the profits while the hardware vendors were (and the few that are left still are) stuck with no way to differentiate their products and are forced to compete on price alone.

While there are many differences between the Mac vs. PC war and the current Android vs. iOS war, the one glaring similarity is the Android hardware OEMs are going to meet the same demise as the PC-clone OEMs. Google will be the only winner. I understand that handset makers were desperate to have a product to compete with iPhone but lacked the skills to develop their own OS. But they all will eventually regret partnering with Google because, in the end, virtually all the OEMs will be forced to leave the handset market. Partnering with Google only postponed the demise of their handset businesses for a few years.

The dreaded “Race To The Bottom”, in its second iteration (mobile), is now in high gear… elsewhere, Wearables and the Internet of Things eagerly await their turn in this incredibly predictable and yet still exciting “Techno-Grand-Prix”…

While all of the other companies are losing money in a race to the end, Apple has the concessions contract for the bleachers.

HTC, say, is 100% proprietary components, so their value added in each device is substantially less than either Apple’s or Samsung’s would be. However, Samsung value-added in semiconductors will be accounted for in the semiconductor division, not Sammy Mobile, and therefore that will understate their profitability per device to some extent. This factor will be bigger now they’ve gone for the in-house chip for the S6. To estimate it you’d have to know how much of their chip output is going into their own devices, which is likely to be a huge pain in the arse, as frex GS 4s for the ROK and Japan had an Samsung-made Exynos, North American ones a Qualcomm Snapdragon, and European ones? It depends!

(the Alex from telco2.net, but I can’t be bothered making up a new login name)

Charles, about:

“So if you subtract those from the sales figures, you get between 8.5m and 22.5m who were new to the iPhone – either upgrading from a featurephone, or coming over from Android.”

Tim Cook’s installed base comment was for % of installed base that upgraded to iPhone 6/Plus since launch.

http://www.wsj.com/articles/can-apple-keep-up-its-growth-spurt-1422493028 (see corrections and amplifications at the end)

Apple sold 10M+ iPhone 6/Plus units from Sep. 19-22. It sold some millions more between Sep. 23-27 (end of FQ4 2014).

Thanks, Mav. It depends what size of installed base you take for the iPhone, and what value of installed base. Canaccord’s latest calculation (today!) reckons it’s an installed base of 404m, and 15% upgraded – so that’s 60.6m.

Yes, if you take in the 10m+ units sold in calendar Q3 then you increase the arrivals from featurephones and Android very substantially. Good point.

“All are weak in software, and there’s no sign of that changing.”

Yeah, no major software innovations coming from any Android OEM.

One could argue that Apple continually steals ideas from android and therefore is weak in the software department.

http://www.businessinsider.com/apple-copied-features-2014-6

And I was making payments with my phone back in 2012. Congrats Apple Pay.

Yes, I realize that those are all Android features not OEM features (although waking your phone by voice was first introduced by Motorola), but there are tons of great features that are created by OEMs that you probably just don’t know about because you only know about Apple. Can you wave your hand over your screen to see notifications? Can your phone detect whether you’re driving and automatically read texts aloud? Can your phone automatically silence itself based on your calendar events for the duration which you do not want to be disturbed? All those are just from Motorola. The others have similar innovations as well.

Enjoy your horribly biased opinion.

This raises the interesting – perhaps fundamental – question of what features actually sell phones. A survey published in May 2014 suggested that “battery life” was the most attractive feature, according to 89% of buyers. After those came brand, (processor) speed, camera quality and screen size. Software features really didn’t figure highly.

You could argue that questions relating to “ability to wave hand over screen and see notifications” or “have texts read to you while you’re driving” or “silence itself based on calendar events” weren’t asked. But if you look at the many features (Smart Scroll, Smart Pause, and any number of other “Smarts”) that Samsung has added and then retreated from in its Galaxy S flagships, it seems that they weren’t really compelling – as much because others would have copied anything determined to be must-have. (Though I’m surprised Android hasn’t copied Apple’s iMessage system, of using data to send “texts” rather than the SMS channel where possible.)

And on the copying point – everyone copies from everyone. iOS has evolved, Android has evolved, Windows Phone has evolved. The jailbreaking community often claims that it’s their ideas, not the big OS developers, which have been copied; that they had them earlier. I leave tracking that sort of etymology to others.

But I think your point about paying with your phone back in 2012 marks you out as someone who is prepared to go to quite a lot of trouble to hunt out a feature and use it. Most people don’t. Look at what people picked in that survey: all things that they don’t have to hunt out, but which are simply inherent to the device (if they get the right device). That’s sort of how TouchID and Apple Pay are presented: you barely have to configure the phone. Zero configuration and maximum utility is the ideal that software aims for.

More to the point, though, none of what you’ve said explains why Android isn’t capturing more of the premium end of the market, and is instead losing sales to Apple. Saying that “it’s just marketing” falls short, because Samsung spends a ton more on marketing and advertising. And if it’s not the software – as you seem to contend, since you’re saying Android leads in that – then that leaves open the question of quite what it is that is causing the drift.

Charles,

Not sure why it doesn’t let me reply to your comment. Anyways…

Why Android hasn’t secured more of the premium market is likely going to change this year. Most of the major OEMs release their flagship in the first half of the year. Makes sense why 4th quarter is also down. Android is starting to focus on being more premium in appearance, something a few of the major OEMs cut corners on, mainly Samsung.

The point I was making is that you have little to no experience or knowledge of Android and you shouldn’t just say he software is weak without really using Android. Proof is in your writing….

“That’s sort of how TouchID and Apple Pay are presented: you barely have to configure the phone. Zero configuration and maximum utility is the ideal that software aims for.”

Google Wallet is just as easy as Apple pay. You are making an assumption that Google wallet is hard to use or that it’s some crazy feature that is hard to find. Simply not true.

“…I’m surprised Android hasn’t copied Apple’s iMessage system, of using data to send “texts” rather than the SMS channel where possible.”

Google Hangouts. It’s also available on iOS, not exclusive to Android. You can even make calls and video calls, all in one app. Cool huh?

I didn’t hunt for these apps like they are secrets. The problem I see is that those who are loyal to Apple assume they have the easiest features or that Android doesn’t have the same capabilities and that’s just not true.

I’d encourage you to try Android and experience what it has to offer before saying it’s software is weak. It makes one look foolish.

Also, I don’t disagree about the important features of a phone. And frankly, Samsung has come up with garbage ones. That’s what’s beautiful about Android is that you have options. There are many great android phones that offer incredible battery life, cameras, quality and screen size.

Pingback: ขายดีจัด เผยข้อมูลส่วนแบ่งตลาดสมาร์ทโฟนประจำไตรมาสที่แล้ว Apple กวาดรายได้ไปทั้งหมด 93 เปอร์เ

Pingback: The iPhone and iPad reportedly captured 93% of mobile device profits in holiday quarter, 79% across 2014 | Apple News

Pingback: Start up: the internet of advertising things, (more) smartphone profits, Left Shark attack!, the death of good sound, and more | The Overspill: when there's more that I want to say

Pingback: The iPhone and iPad reportedly captured 93% of mobile device profits in holiday quarter, 79% across 2014 - Westhype

We can expect Apple’s marketshare to grow even faster than their sales in the near future. Why?

The second hand market, not just among lower income groups in developed nations, but also the third world.

Both of these are huge groups, that the Android manufacturers were expecting to tap into, and which were usually considered outside of the reach of Cupertino because of Apples premium products and prices.

But instead of a 600$ iPhone 6, how about a 50$ iPhone 3GS or 4 or an 80$ iPhone 4 and 100$ iPhone 4s? And instead of a 300$ iPad mini2, how about an 80$ ipad2 or 100$ iPad mini 1?

A similar market for second hand luxury cars (and to a lesser degree computers) already exists. And while enterprising individuals and companies are already shipping formerly premium phones to low income markets will see major grow in the near future. Why?

1: Quality hardware. Both iPhones and iPads are very well built devices. And in many cases, unless the mainboard is fried, a formerly cracked iPhone can get an inexpensive front/rear cover and battery change, and be as good as new.

2: User experience. Even though iPhones have seen tremendous growth in CPU power, an iPhone 4 is a much better and faster experience than a 4 generations old laptop used to be. As someone with years of experience with both iOS and Android, IMHO the experience a user gets from even an iphone 4, is equal if not superior to what he would get from a 100$ Android phone. And the most important differentiator between the two OS’s: The software market, is also in the iPhone 4s advantage.

3. The brand cachet and prestige that comes from an Apple product, is even more relevant in these markets. And is much higher than what a buyer may get from a 100$ Android phone or tablet.

As faster and faster iPhones and iPads come out, the number of still functional but recently updated iPhones and iPads will keep growing. And the market value of these will keep falling, which is what makes it profitable for someone to buy for 20$, refresh and repair for 20$, and sell for 100$ in a low income market.

It won’t be tens of millions of phones and tablets, but it will be in the millions. And it’ll be millions of customers that’ll come from the Android market where every penny counts.

But as someone who have a couple of years experience with both iOS and Android, I can say without a doubt

Interesting points. The secondhand* market is a sort of dark matter of mobile (to quote Benedict Evans), but there is evidence that Apple has quite a chunk of it, especially in China.

* (also “stolen from abroad”)

Pingback: Smartphone OEM Profitability Analysis | Somedroid

I switched from android to ios a month or two ago. Why? because the iphone hardware is unambiguously better. The OS is arguably a bit worse, but iphones have the best cameras and the best battery life, no argument. When the android hardware vendors actually choose to step up and compete on quality hardware, I’ll switch back.

Best camera?

Erm, only if you ignore the phones with vastly superior cameras (eg Lumia 1020)

The 1020 does have a lot of pixels, it’s ttue, but it is seen as slow and the phone itself is hard to get hold of. Was years shead of its time, and of processor speeds.

Pingback: 02/11/15 - Wednesday AM Interest-ing Reads -Compound Interest Rocks

Pingback: Android OEM profitability, and the most surprising number from Q4’s smartphone market | Dewayne-Net Archives

Pingback: Weekend Reader Woche 7 - Philip Büchler

@Dairyaire wrote, “Also, I don’t disagree about the important features of a phone. And frankly, Samsung has come up with garbage ones. That’s what’s beautiful about Android is that you have options.”

The chemistry isn’t quite like fine wines — where adding a teaspoon of sewage to a bottle of Chateau d’Yquem produces 775 mL of sewage—but your claims about “Android” seem to highlight the similarity.

Samsung, the biggest seller of premium phones, “has come up with garbage” features. But…you have a choice to get a tainted bottle of Montrachet! Or perhaps a foul-smelling Riesling is up your alley?

Android is NOT a phone, because you cannot buy an Android® phone. It is a platform where all the OEMs are doing their damnedest to make it hard to compare features with one another. Result: Comparing an HTC, LG, Samsung or whatever, you get a mishmash of features that may be well-done, may be garbage or may be absent entirely. You can run Google Wallet but only hardcore payments experts will know how secure your credit card data, and your transaction data, is. You will not know whether you will be able to get an OS upgrade that’ll fix any of the currently severe extant malware attacks; you may not even know that the phone in the store is a version or two back from the current OS and will NEVER get security or functionality fixes.

In this environment, it’s arguable whether there even *IS* such a thing as a premium Android phone. You might like to think that marketing is trivial, but Google’s and its OEMs’ indifference to customer service, after-sales support and a roadmap takes the polish off their very fine hardware and turns it into muck.

PS: Thanks to @Dairyaire for indicating thru his/her pseudonym, what we are meant to think of him/her.

Pingback: Week 7 | import digest

Pingback: Microsoft’s per-handset profit, or the lack of it – and its impact on Windows Phone’s future | The Overspill: when there's more that I want to say

Pingback: Android (and Apple, and BlackBerry, and Microsoft Mobile) handset profitability – the Q1 scorecard | The Overspill: when there's more that I want to say

Pingback: India’s Snapdeal, Intex Seek An Android Alternative | TechCrunch

Pingback: Microsoft, Bloatware, And Android OEM's - Greg Morris

Pingback: Premium Android hits the wall: the Q2 2015 smartphone scorecard | The Overspill: when there's more that I want to say

“Let’s be clear: I think Android is a boon to the world; quite possibly it’s the best invention of this century so far.”

LOL! You are out of your damn mind.

No, I’ll defend that: it has enabled millions – billions? – of people in countries where a PC would be prohibitively expensive and require expensive mains power to instead access the internet wherever they are, at costs that are falling all the time (for the devices, at least). And it’s available as open source for companies to build on – which they’ve done in China and beyond. What Linux is to bigger computers, Android is to smartphones. (Of course it shares a parentage.)

Pingback: Microsoft, Bloatware, And Android OEM's - Euro Tech

Guys Huawei honor hardware specification is gud.. But in matter of software it is very very worse no regular update.. Only launching new mobile in market . without careing thinking about old mobile updates..they don’t think about customers..

It completely break official stock version android os..

And many features are removed and not support even 3rd party apps..

1) no multiple user

2)no call recorder even 3rd party apps not supported

3)no music equalizer

4)no motion gallery

5)no launcher

6) notification bar worse

7)very low volume

8)charger heated up quickly,

9)time lagging while typing long msg

10) no option to shot pic while typing wrong password in main screen.

11) net data controler worse

12)in status bar, notification icon are very small

13) no regular updates

Guys very very worse mobile. Alternate brand is much more better than honor at same price rate. It’s emui 4.0 is worse..

boycott Huawei..I greatly mistaken by purchasing this honor 4x and 4c mobile..I have wasted rs11000+9000..

I got frustrated of these

Xiaomi is the best

Pingback: Microsoft, Bloatware, And Android OEM's - MobileTechTalk

Pingback: Apple (AAPL): Reviewing One of Warren Buffett's New Dividend Stocks - Simply Safe Dividends

Pingback: Apple Inc.: One of Warren Buffett’s New Dividend Stocks (AAPL) – The Weekly Options Trader

Pingback: The Facebook Revolution – Internet Transformations